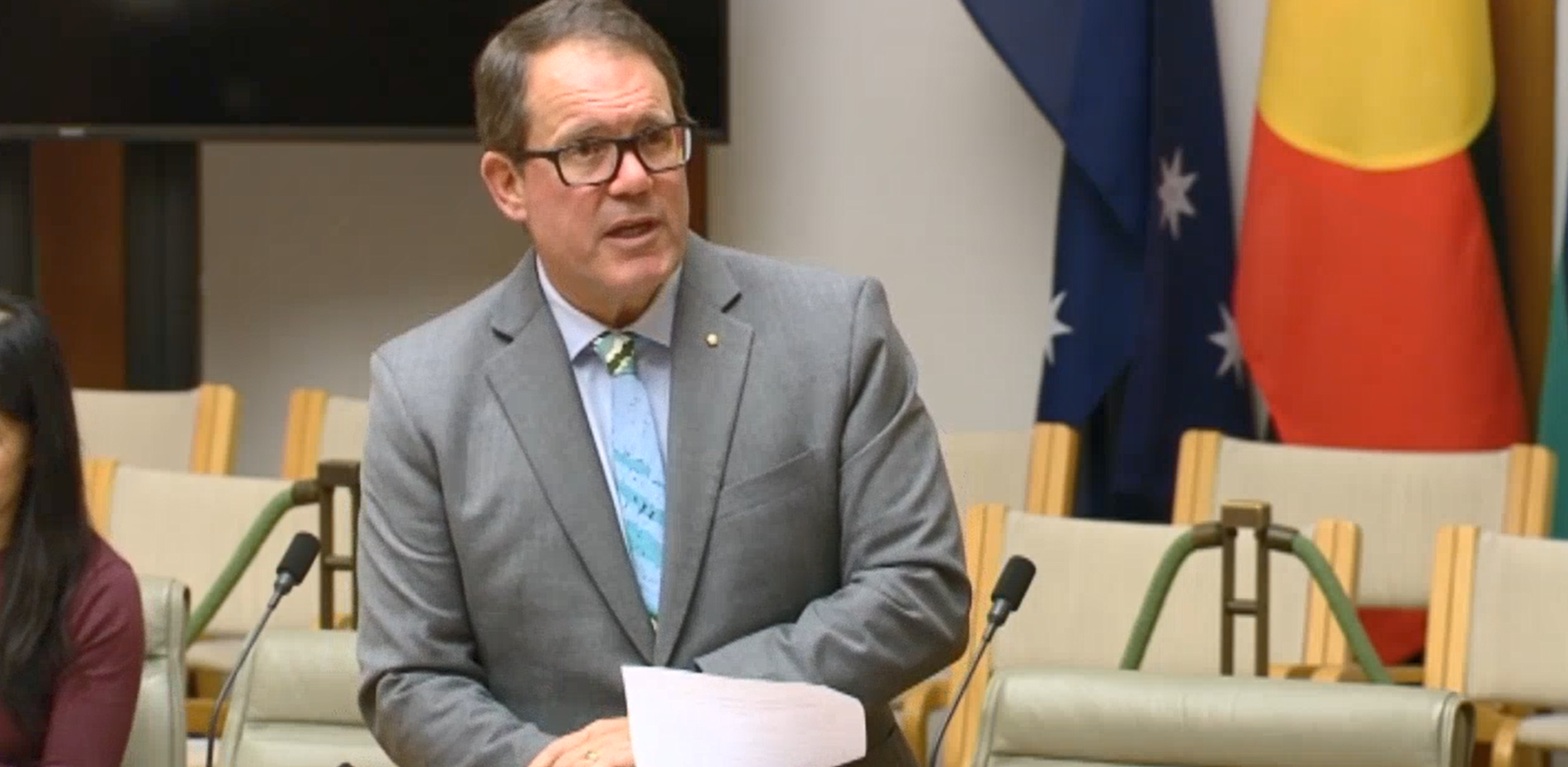

Deputy Speaker,

The development of Northern Australia depends heavily on the availability and affordability of insurance—particularly cyclone insurance.

Besides cyclones’ immediate trail of destruction, at least half of all flooding in Northern Australia is cyclone related.

Without affordable insurance in Northern Australia, businesses are deterred from expanding.

Investors are deterred from investing.

Developers will not take on projects.

People are either reluctant to move to Northern Australia or may even relocate to the southern states.

A range of social infrastructure facilities such as aged care may no longer be able to operate profitably.

And rents increase, which puts strain on people who have lower incomes.

As the report before us rightly notes, without affordable insurance, Northern Australia cannot flourish.

And that is why the Cyclone Reinsurance Pool is so vital.

On average, Northern Australians get slugged with $2,370 for residential combined building and contents insurance.

Other Australians pay only $1,350.

Strata insurance was over double the premiums paid by the rest of Australia, at around $7,740 for Northern Australia compared with $2,940.

That’s an outrageous difference.

It isn’t yet mandatory for insurance companies to join the pool.

Small insurers of less than $300 million have until December 2024 to join the pool.

And large insurers with a premium over $300 million have until December 2023 to join.

As of February 2023, two insurers—Allianz Australia and Sure Insurance—had joined the pool.

About 14 insurers in Northern Australia are involved in total.

The pool now covers 19 per cent of home insurance sums in Northern Australia.

The chief executive of the Australian Reinsurance Pool Corporation told Senate Estimates last year that there would be premium savings of around 13 per cent for home insurance policies in Northern Australia on average.

Separately, Allianz calculated that the average premium saving would be around 9 per cent in Northern Australia.

And up to 30 per cent on average for some regions within it.

However, the general view that the committee derived from witnesses was that it is still too early to determine whether the pool has led to reduced costs.

RACQ indicated in its submission that evidence did not show widespread premium reductions in Northern Australia.

Deputy Speaker, it is unfortunate that in the previous Parliament the Government raised expectations above what the pool could reasonably be expected to deliver.

Clearly, community expectations of cheaper insurance premiums in Northern Australia have not yet been met.

Instead of overpromising and underdelivering, the previous Government should have been more honest from the start.

It should have acknowledged that this is a process that was going to take time.

Another disappointment is the treatment of the Northern Territory by some insurers.

The Chamber of Commerce NT said that the most significant issue for the NT is a ‘lack of interest from insurers even in participating’ in the region, with ‘barely less than 10 or 15 that actively wish to participate in our marketplace’.

Some insurers call for more mitigation investment, such as improvements in zoning, building codes and land use planning in the NT.

But that is already happening.

And it isn’t a reason to penalise Territorians, who are among the most exposed to dangerous cyclones.

In Darwin, Cyclone Tracy still casts a long shadow that has informed how we rebuild buildings to robust standards.

I regret that few insurers have signed up but I hope we’ll see participation increase this year and out to 2024.

Overall, the committee had serious concerns about the ongoing implementation of the pool to date.

In its recommendations, the report before us called for ensuing that:

- Future releases of modelling are provided well in advance of key dates in the ongoing roll-out of the Cyclone Reinsurance Pool;

- The Australian Government reviews the availability and coverage of insurance in Northern Australia and the impact of the 48-hour clause on the cost of insurance premiums for Northern Australians;

- The Australian Government directs the ACCC to monitor the cyclone insurance markets in Northern Australia;

- The Australian Government announces a position on the inclusion of marine insurance in the Cyclone Reinsurance Pool;

- The Australian Government facilitates a coordinated approach to land use planning, building codes, mitigation and disaster resilience; and

- The Australian Government’s 2025 review of the Cyclone Reinsurance Pool considers evidence and data on whether to ‘sunset’ the Cyclone Reinsurance Pool’s coverage of policies for new builds past a certain date.

It is too soon to determine whether the pool is working effectively to reduce premiums in Northern Australia.

Which is why this committee will report on the Cyclone Reinsurance Pool again when more insurers have joined.

Insurance affordability in Northern Australia remains a key concern for this committee and for me personally.

And I will keep fighting for a fairer deal for the North.

Thanks Deputy Speaker.